Recent Posts

Top Causes of Water Damage

10/27/2023 (Permalink)

Water damage in Wichita, KS is a common occurrence. We should know, we have been helping businesses and homeowners in Wichita recover from flooding and water damage every day for nearly 20 years now. Over that time we have seen a lot disasters and we’ve picked up tips for what you can do, saved all kinds of materials from getting destroyed and met a whole lot of great people. After talking it over we have determined from our experience what Wichita’s top 3 causes of water damage are and have some tips for what you can do to prevent them!

- Fridge Water Line: In the last few years we have seen more and more water losses caused by the water supply to refrigerators. Most of those have happened during a move or a new appliance installation. Make sure you double check the connection when you first install that water line!

- Sump Pump: Wichita is full of finished basements and sump pumps. Especially when heavy rains come we see a huge uptick in flooded basements caused by the rain. Check out our blog about what you can do to prevent your basement from flooding.

- Broken Pipes: The worst damage is almost always due to a broken pipe causing flooding. There are a few things you can do to prevent this. Getting a plumber to inspect your pipes with a snake tool, keep an eyes our for water spots often pipe breaks start as pinhole leaks, pay attention to your water pressure if it goes down that could indicate a leak. Finally make sure you know where your water shutoff is, in the case of a broken pipe you can massively decrease the damage it does if you can shut the water off immediately.

If you experience any water issues, flooding or even suspect it our highly trained technicians can help identify water damage and get you a plan to restore your property. Give us a call today at 316-684-6700.

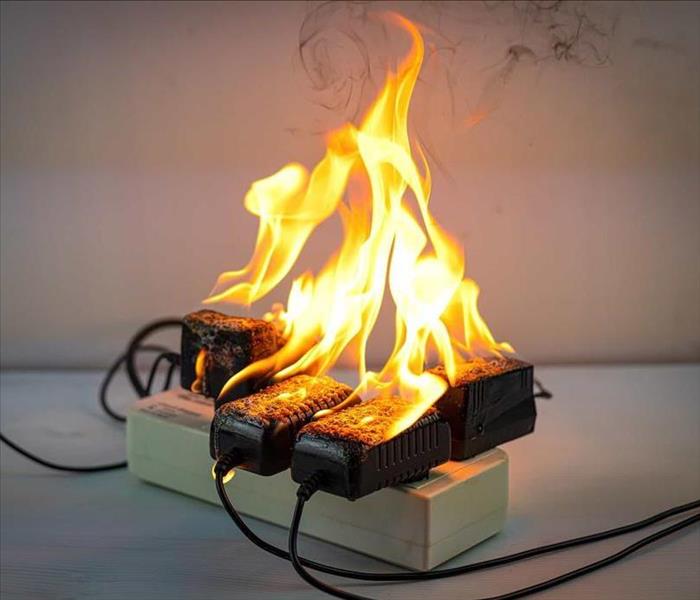

Safeguard Your Wichita Home with These Fire Safety Tips

10/16/2023 (Permalink)

Home fires can cause irreversible damage. Did you know that in most cases, cooking and heating are the leading causes of home fires and fire injuries? In the event of a fire emergency, you may have as little as two minutes to evacuate. The most effective way to protect your home and yourself is to identify and remove fire hazards. Here are some key fire safety tips that have been provided by the NFPA (National Fire Protection Association):

Fire Safety Tips:

- Develop multiple escape plans and practice them with your loved ones. Your plans should include escape routes from different areas of the house, tools for exiting the building (escape ladders, items to open, break out windows) and a designated meeting place.

- If a fire occurs in your home, GET OUT, STAY OUT and CALL for help.

- Install smoke alarms on every level of your home, inside bedrooms and outside sleeping areas.

- Test smoke alarms once a month, if they’re not working, change the batteries.

- Carbon monoxide alarms are not substitutes for smoke alarms. Know the difference between the sound of smoke alarms and carbon monoxide alarms.

Preparing and Preventing a Home Fire - Steps You Can Take Now:

- Have your chimneys, fireplaces, wood stoves and central furnace serviced once a year.

- Keep items that can catch on fire at least three feet away from anything that gets hot, such as space heaters.

- Avoid smoking in bed.

- Educate your children regularly about the dangers of fire, matches and lighters, and keep them out of reach.

- Turn off portable heaters when you leave the room or go to sleep.

- Never leave burning candles unattended.

- Keep an eye on your cooking.

National First Responders Day

10/5/2023 (Permalink)

Celebrating our First Responders!

Celebrating our First Responders!

SERVPRO does all kinds of disaster response from residential home fires to catastrophic storms which can devastate communities. In the process of doing that work we end up following behind first responders all the time and we see firsthand the incredible work they do for communities across America. That’s why we work to raise money, awareness, and gratitude for our first responders because their sacrifice makes America what it is.

National First Responders Day

Last year we heard about National First Responders Day which is on October 28th and we thought it would be great if we put together an event where the community could show our gratitude to first responders from around the Wichita area. So that is what we did! With the help of 26 other businesses we were able to raise money, resources and put together over 200+ hot lunches for first responders around Wichita.

We set-up a drive thru where Law Enforcement Officers, Firefighters, EMS and others could come by and get a free hot meal prepared by our volunteers. Many stayed for a while and shared experiences they have had while working. Here is a link to our Facebook live stream of last years event where you can watch all the great time we had.

This Years Event

This will be our second year doing this event. We have gathered many more business partners than last year and are looking to serve some awesome homemade BBQ to any first responders who want a delicious meal. This year October 28th falls on Saturday and we will be setting up our drive thru in the Central Christian Church parking lot at 2900 N Rock Rd. from 11:00AM to 2:00 PM.

Reach out to us at 316-684-6700 if you would like to sponsor or contribute this year!

SERVPRO of Northeast Wichita is Helping Businesses Near You!

9/22/2023 (Permalink)

The work done in offices across Wichita needs focus and energy daily to stay running efficiently even when everything is going well. The last thing any business needs is a broken pipe or some other water intrusion disrupting your day to day and costing you valuable time. That is why hiring professionals like SERVPRO® to assist with the water cleanup and restoration is one of the best moves you can make.

Here at SERVPRO of Northeast Wichita we know that the major concern for water cleanup in commercial buildings is speed. That is why we focus on arriving on the scene as quickly as possible, gather information on the loss, and taking measures to mitigate the water as quickly as possible. We focus on drying down your building and preventing odors or mold growth from cropping up. We do all this while making sure to communicate the process and status of the drying process to you and your company. Our whole goal in commercial water restoration is to make the process as brief and clear as possible for you and your company so you can get back to focusing on your work as scion as possible.

We have been working in the Wichita, Andover and Derby areas since 2001, over 20 years!! We currently work with many businesses, manufacturers and Church's with Emergency Ready Plans. Give us a call today and find out how we can help your business reduce the impact of a loss for free: (316) 684-6700.

How Your Business Can Be Affected By Water Damage

9/21/2022 (Permalink)

When you think about commercial water damage, you might think of a large storm coming through and causing flooding. Many people forget that storms and severe weather aren't the only causes of floods and water damage wreaking havoc on your commercial property. Here are 4 ways your Wichita, KS business can be affected by water damage.

Malfunctioning sprinkler systems

While emergency sprinklers are an imperative component of fire safety, they can also cause commercial flood damage if they are faulty or need to be replaced. This could cause damage to your property, such as products, documents, and electronics.

- Damaged appliances

Most businesses have appliances that require water hook-ups. Such as refrigerators, ice machines, and even dishwashers. If these malfunction and/ or are damaged this can cause a water emergency. One thing we recommend is using metal braiding lines on your water hookups.

- Broken pipes and plumbing

The most thought of water emergency is a pipe bursting and breaking. Broken pipes can cause catastrophic damage to a commercial property. These situations can be so catastrophic because if the breakage happens when the building is empty the constant supply of water from the pipe will not stop until the water supply is turned off. This can lead to possible mold growth as well, if it’s not taken care of or found quickly.

4. Backed up sewer lines

This is another cause of water damage that isn’t often thought of. If the sewer line to your building backs up or becomes damaged, it can cause damage from both the backed up water and the level of contamination of that water. This water is what we would consider “black water” and requires a much different approach than other water damage situations.

Business owners tend to overlook these events, should your business suffer from water damage you can count on SERVPRO of Northeast Wichita, we have your back! We are available 24/7 for your commercial emergencies! Give us a call at 316-684-6700.

No Job Is Too Big!!

9/21/2022 (Permalink)

SERVPRO of NortheastWichita not only handles residential jobs, we can tackle commercial jobs as well, no job is too big. We have the equipment and vehicles ready for whatever is needed to get your business back up and running again. SERVPRO has over 1,700 franchises that are ready to help with more equipment and people if needed, so you don’t have to be worried about the capacity of your job. The Federal Emergency Management Agency(FEMA)claims that nearly 40% of businesses that close due to a disaster fail to reopen. The businesses that can reopen normally usually have some type of emergency plan set up to ensure a fast and efficient shift back to normalcy. SERVPRO of NortheastWichita actually offers an emergency ready plan at no cost to you, check out ourblogto learn more.

SERVPRO of Northeast Wichita recently handled a job in a building that was over 6,500 square feet. This building was affected by a water fountain malfunction that caused standing water throughout the structure. Sometimes, with large commercial jobs we have to create the most effective environment in order to dry areas efficiently. Water damage doesn’t always happen close to drains, so we must be ready for whatever happens. We often bring large buckets to drain the dehumidifiers hoses in. Dehumidifiers can suck up to 125 PPD out of the air a day and that water needs to go somewhere so the dehumidifier can pump its reservoir tank.

We are ready 24/7 for any emergency that may occur where you would need our assistance. If you are experiencing a water damage loss of any size give us a call, day or night (316) 684-6700.

Dry VS Wet Smoke Damage

9/21/2022 (Permalink)

What is smoke?

Smoke is a collection of tiny solid, liquid and gas particles. Although smoke can contain hundreds of different chemicals and fumes, visible smoke is mostly carbon (soot), tar, oils, and ash.

There are two different types of smoke–wet and dry. As a result, there are different types of residues after a fire that SERVPRO of Northeast Wichita will assess when they arrive on scene. With the different types of residues, there is also different types of cleaning.

Wet Smoke Damage

Wet smoke is usually produced from items made of plastic or rubber, from a slow burning, low heat fire. Protein fires also create wet smoke, these types of fires are quite common, very difficult to clean, very greasy and quite pungent. Wet smoke damage will leave thick, black, and sticky residue with a lingering smell.

Dry Smoke Damage

Dry Smoke is created by a fast burning, high-temperature fire, usually started by paper or wood. This is one of the most common types of house or business fires and is one of the larger loss types of fires. Dry smoke is an easier to clean smoke as it has a powdery texture and won't smear when cleaning.

Each smoke and fire damage situation is different, they all need a specialized solution customized for the specific event. SERVPRO of Northeast Wichita has the specific damage restoration training, personnel, and equipment and can quickly restore your home to pre-fire condition. Give us a call (316) 684-6700.

Do You Have Hidden Water Damage?

8/20/2022 (Permalink)

If your Wichita KS home is affected by water damage, you will want to have it restored as quickly as possible, in some cases, water damage can go unnoticed until it is too late. The longer water damage is left unaddressed, the more destructive it can be to your home. It can be confusing to know the warning signs of water damage in your Wichita KS home, so here are a few signs to look out for!

- You have mold. Mold spores are everywhere but once they find moisture, humidity and consistent temperature mold will begin growing, reproducing, and degradating the materials they are growing on. Without water, mold spores would n be able to grow and spread, crazy enough mold can start growing in as little as 48 hours. Even higher-than-normal indoor humidity can support mold growth. SERVPRO of Northeast Wichita recommends keeping indoor humidity below 45 percent. Mold is typically a sign of persistent water intrusion.

- Bubbling or discoloration in your walls, floors, and ceilings. One of the easiest ways to tell if you have experienced water damage is a visual cue. Your wallpaper may bubble, paint may peel, and hardwood floors may buckle or warp, checking for softened drywall is also something that is simple, but most people don’t think about doing that. Water can even get behind latex paint and bubble up like a water balloon.

- Unusually high water bills. An unusually high water bill can indicate that there is an unnoticed leak somewhere in your home. No one likes getting bills in the mail, and when we open it up and see a number double, or triple what we were expecting, it’s recipe for a heart attack. Check for leaks under the sink, in a crawlspace, or even a leaking toilet.

Water damage is never fun and often leads to other issues, which is why it is so important to call a disaster restoration company like SERVPRO of Northeast Wichita if you detect it in your home. Our team of professional technicians is always ready to help, so give us a call today! (316) 684-6700

Ways To Get Rid of Smoke Odors in Your Home

8/20/2022 (Permalink)

Fires in your home, no matter the size, can be truly devastating. The worst fires can completely destroy your home and everything inside. Smaller fires can still damage your valuables in your home or business. One of the major effects of fires is actually the smell. For weeks and months after your fire you may still have that lingering smell, let SERVPRO of Northeast Wichita help. We have some effective methods of removing the unwanted stench of smoke and the damage it can cause.

Do it Quickly

Even the slightest amount of smoke in your home can cause problems. It is important to immediately open windows and ventilate the house. Then, you should get right to work. Give SERVPRO of Northeast Wichita a call to come and assess the damage, we are available 24 hours a day 7 days a week, so when you have a traumatic event, such as a fire, you don’t have to wait. It is even more important to call us immediately if your structure is unsecured because we are able to provide board-up services.

Get The Materials Needed

You will want to make sure you have the right equipment and supplies to combat smoke damage. Some of the best smoke cleaning tools are the following:

- Dry Sponges

- Cleaning Productions designed specifically for fires

- Air filtration devices

- Ozone machines

- Thermal foggers

Air filtration, ozone machines and thermal foggers are designed especially for some of the worst smoke odors and damages from smoke. Here at SERVPRO we use these devices to help ensure a home is as close to its original state as possible, "Like it never even happened." If you experience fire or smoke damage in your Wichita, KS home or business please give us a call 316 –684-6700.

Preventing Commercial Fires in Wichita KS

8/20/2022 (Permalink)

Most of our blogs are all about residential fire safety. There are so many safety tips we can give you about fire hazards in and around your home, but one thing most people don’t think about are the fire hazards that are also at your place of work. According to the National Fire Protection Association (NFPA), the five most common causes of fires in commercial buildings are cooking equipment, heating equipment, electrical and lighting equipment, smoking materials, and intentional fire setting. By learning the most common workplace fire hazards, you can better protect your commercial property and those working in it.

Circuits

Almost every commercial property is equipped with electrical circuits, which can have many electronic devices to which they must provide power. As a result, it is common for electrical outlets to be overloaded in workplaces. This can cause an overload on the circuit and as a result overheat and cause a fire. Making sure your extension cords aren't damaged and that your outlets aren’t overheating are great ways to help prevent electrical fires.

Dust

If dust sits on top of surfaces for extended periods of time, it can become a fire hazard. In a workplace environment, dust can accumulate on electronics and surfaces around the office, it can ignite quickly if heaters or electrical sockets cause a spark. In order to decrease your workplace’s risk of fire, be sure to regularly clean dust off of surfaces, including hard-to-reach areas.

Flammable Liquids and Materials

There are many flammable liquids and objects commonly found in workplaces for many different reasons. If there are flammable liquids inside of your workplace, be sure to contain them and limit their exposure to sparks of flames by keeping them sealed and located in a dry place. If a fire ignites, these flammable liquids or materials can spread the fire quickly and be a catalyst.

If your commercial property is affected by a fire, you can take comfort in SERVPRO of Northeast Wichita’s commercial services. We are available 24 hours a day, 7 days a week. Give us a call at (316)684-6700.

24/7 Emergency Service

24/7 Emergency Service